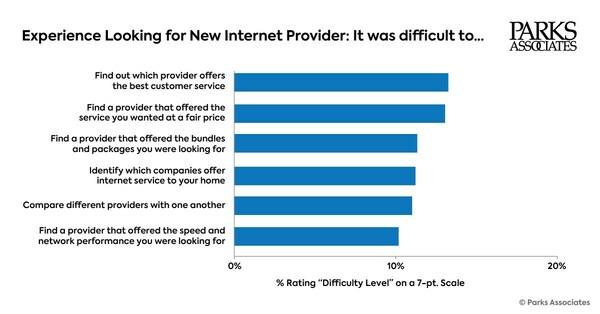

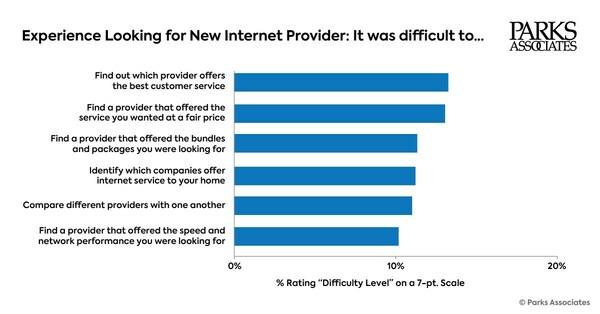

According to a recent study by Parks Associates, almost 30% of U.S. households that subscribed to a new home internet provider in the past year reported at least one difficulty.

According to a recent study by Parks Associates, almost 30% of U.S. households that subscribed to a new home internet provider in the past year reported at least one difficulty.

They mentioned challenges such as finding a provider that offers service at a fair price, comparing different providers with one another, determining which provider offers the best customer service, etc.

But is this information just difficult for consumers to find on their own, or are providers intentionally making it hard to come by? “It’s a little bit of both really,” said Kristen Hanich, director of research at Parks Associates.

She told Fierce historically, public information on internet provider availability has shown census block level availability, which doesn’t actually show if a specific address can receive service.

So, a customer can “look up their address online and in one of these databases to see which companies they can receive service from. And they can see a list of maybe 10 different companies, but they can only actually receive service from one or two.”

One reason that happens, Hanich explained, is because many databases on internet availability were set up 20-30 years ago, and they “were kind of stitched together from a lot of local providers.” Those companies may have been acquired by larger ISPs and “the data around what was available was just never standardized.”

“We’re seeing that people are improving the data there but it’s still not where it would be useful for actual folks,” Hanich said.

“A lot of times, the pricing and promotions available are hyperlocal, so it’s very specific to where you live and kind of what the competitive environment is there,” she explained. “So [ISPs] tend to tailor offerings to what is specifically in that area and…their competitors want to know that information as well.”

As Parks Associates’ survey pointed out, consumers are finding it challenging to find a new broadband plan for “a fair price.”

“I think there is now an expectation that you should be able to pay about $50 bucks a month and maybe receive 100-200 Mbps for that plan,” said Hanich, adding fiber providers have started to come up with gigabit plans “where you can pay maybe $60 per month.”

In a press release on the report’s findings, Hanich noted nearly 40% of U.S. internet households reported download speeds under 250 Mbps, “and these consumers are largely dissatisfied with their current service.”

“These dissatisfied internet users represent a ripe market for ISPs looking to expand their customer bases into new markets,” she said.

Asked if she thinks the average price of internet is going up, Hanich said, “compared to where the market has been historically, it’s a little further down.”

However, “with the Affordable Connectivity Program looking to end this year, a lot of people are effectively going to be paying more for their service.”

From the article, "One-third of consumers say they have trouble finding a new ISP" by Masha Abarinova

According to a recent study by Parks Associates, almost 30% of U.S. households that subscribed to a new home internet provider in the past year reported at least one difficulty.

According to a recent study by Parks Associates, almost 30% of U.S. households that subscribed to a new home internet provider in the past year reported at least one difficulty.