By the year 2024, the traditional pay-TV subscriber base will decline to 53 million US households

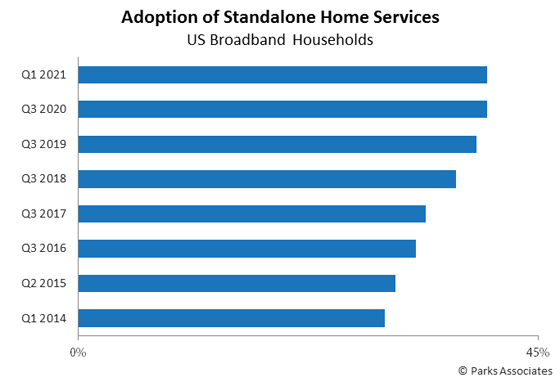

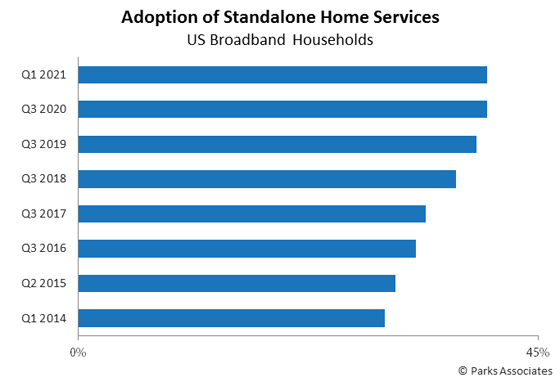

New research from Parks Associates estimates that between 2014 and 2020, the US pay-TV industry lost over 18 million subscribers, while the broadband market has accelerated, with 40% of US broadband households receiving a standalone service. In 2020, over seven million households dropped their pay-TV services. Traditional pay TV — television services delivered over an operator-controlled network to an operator-controlled device — declined by an estimated 10 million subscriptions.The industry report "Modern Broadband: Shifting Landscape," by Parks Associates’ Sr. Analyst Kristen Hanich, investigates new developments in the broadband market spanning business opportunities, operational needs, and competitive factors for broadband players.

“Online pay-TV service from virtual MVPDs, players that target the general population instead of offering services to a specific geographic footprint, grew by an estimated three million,” said Kristen Hanich, Sr. Analyst, Parks Associates. “vMVPDs overall have grown to represent an increasingly large percentage of the pay-TV market — accounting for 16% of US pay-TV subscriptions in 2020.”

In the US market, vMVPDs represented the only segment of the pay-TV space to experience growth during the COVID-19 pandemic. Parks Associates estimates that by the year 2024, the traditional pay-TV subscriber base will decline to just 53 million US households — while vMVPDs will increase to over 23 million.

Internet service providers and others operating in the pay-TV space are thus seeking alternatives to traditional pay TV in their consumer services arsenal. Cablecos in the United States have had some success in encouraging new bundling by launching Wi-Fi-first MVNO services, primarily running on Verizon’s network. In Parks Associates’ Q1 2021 survey, 4% of US broadband households reported subscribing to Comcast Xfinity Mobile, Spectrum Mobile, or Altice Mobile — making them some of the largest players in the MVNO space.

“US ISPs collectively have over 110 million residential and small business internet subscriptions as of Q1 2021,” Hanich said. “The standalone broadband market will continue to grow, increasing pressure on these service providers to find the next combination of services that best leverages this massive subscriber base.”

For more information on Modern Broadband: Shifting Landscape, contact sales@parksassociates.com. To schedule an interview with an analyst or to request specific data, please contact Rosey Ulpino at rosey.ulpino@parksassociates.comor 972-490-1113.

{block identifier='parks-associates-boiler'}