Many auto industry players are preparing for consumers to shift their attitudes toward car ownership. The thought is that in the future, a greater percentage of consumers will lose interest in owning a car and will instead opt to use ride sharing services like Uber as a substitute for ever owning a car. The change in attitude toward car ownership is, many maintain, the future of mobility. At auto industry conferences, the future of mobility is a hot topic of discussion, as is how to deal with the impending changes in perception about mobility. At investor meetings, automakers need to present plans for how to prepare for the potential dip in vehicle sales due to such changing attitudes toward mobility.

To prepare for the shift in ownership, some automakers have already invested in ride sharing services to acquire a share in the rising trend. Some automakers are in the process of creating their own ride sharing service to compensate for the potential dip in car sales. Others have long-term plans to introduce self-driving vehicles through a ride sharing service.

These strategies are forward-thinking ways for automakers to acquire new revenue streams, but perhaps it’s time to challenge the fundamental assumption about why there will be a shift in perception about mobility. The most-often cited reason by the press is Millennials’ behavior—Millennials (the 18-34 demographic) are more likely than any other generation to use Uber or Lyft. Since Millennials are used to using ride sharing services, so the reasoning goes, they will become accustomed to using cars without owning them and so will lose interest in owning their own car.

It is, in fact, true that Millennials are more likely than any other generation to use Uber or Lyft. According to Parks Associates’ consumer data, Millennials are over 50% more likely than Generation Xers (the 35-44 demographic) to use ride sharing services Uber or Lyft.

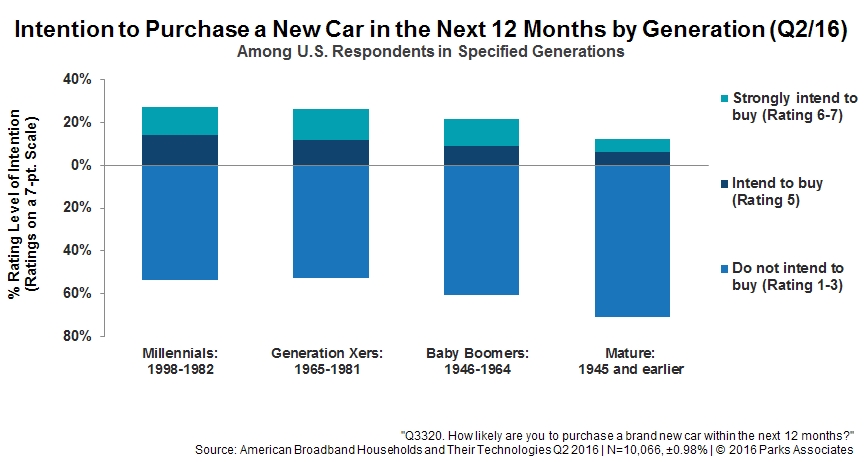

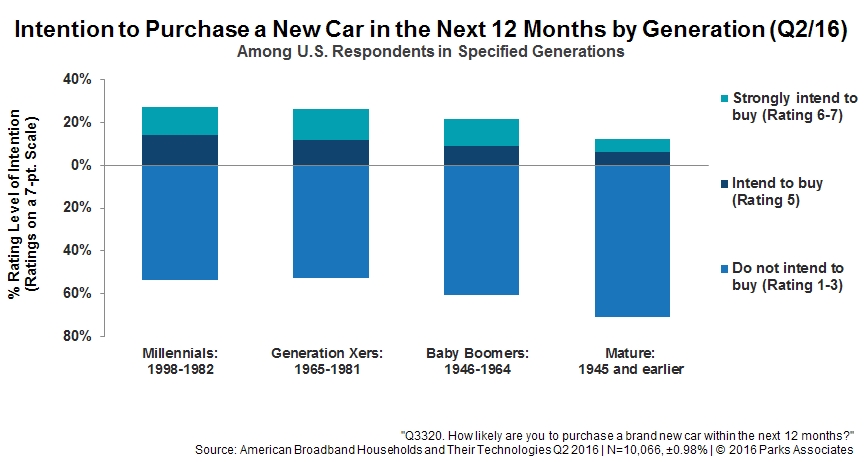

It is not true, however, that use of Uber and Lyft makes Millennials’ less likely to own their own vehicle than other generations—Generation Xers, for example. According to Parks Associates’ consumer data, just as many Millennials intend to purchase a vehicle in the next year (27%) as Generation Xers (26%), and almost just as many Millennials strongly intend to purchase a vehicle in the next year (13%) as Generation Xers (14%). These percentages should be surprising, because historically, consumers 18-34 years old have been much less likely to purchase a car than consumers 35-44 years old. Even more surprising: Millennials who use Uber are even more likely to strongly intend to purchase a vehicle in the next year (17%) than Millennials in general (13%).

One might theorize that perhaps younger Millennials (18-24) are less likely to purchase a new car in the next year than are older Millennials (25-34). We found that this difference in purchase intention is insignificant.

So we conclude, based on our data, that although Millennials are much more likely to use ride sharing services than Generation Xers, they are interested in owning a car, too—just as, or more, interested than Generation Xers. Just to be clear, this data does not mean that auto sales will not decline; what it does mean, however, is that the main reason for thinking there will be new mobility patterns to replace vehicle ownership is not based on current consumer attitudes.

For more information on Parks Associates' research on sharing economy apps like Uber and Lyft, see industry report Disruptions from Sharing Economy Apps.

Further Reading: