Since HBO’s late 2014 announcement that they would go direct to consumer, the TV industry has been abuzz. Speculation about the impact of the service has ranged widely, from those who see the service as a valuable tool to reach Millennials to those who see it as the beginning of the end for pay TV as we know it.

This speculation was heightened in the past few days. As has been reported in several of the cited articles, a recent Parks Associates survey of 10,000 U.S. broadband households found that 17% of households surveyed are likely to subscribe to an over-the-top (OTT) video service from HBO. Here are a few examples of the recent coverage:

CinemaBlend - HBO Standalone May Convince An Insane Number Of People To Drop Cable

Huffington Post - Standalone HBO Could Inspire Millions to Ditch Cable, Survey Says

Light Reading - Parks Predicts HBO OTT Success

New York Post - Broadband households eager for cable-free HBO

TechnologyTell - Would you cut the cord for standalone HBO? Many customers would too

With so many opinions surrounding this new data, Parks Associates would like to provide some additional context regarding the research, associated market trends, and potential outcome.

First and foremost, the responses from consumers are a testament to the popularity of HBO’s brand and the content it offers. HBO’s history in popular original content is clearly driving demand. At the same time, the adoption and use of HBO Go among subscribers (or even non-subscribers) has allowed consumers to sample what the experience could be like for an HBO OTT service.

Second, it underscores the upward trend of OTT video services in the United States. At present, approximately half of U.S. broadband households subscribe to an OTT video service, and the entry of HBO into the OTT market stands to expand OTT service subscriptions. That said, the service is not yet available. Additionally, the survey suggested a $14.99 monthly price tag. HBO has not officially stated a price for the service.

A significant amount of attention has dwelled upon the potential for cord-cutting that an HBO OTT service might drive. According to the survey, 91% of those who are likely to subscribe to the HBO service also currently subscribe to a pay-TV service. About half of those consumers, or 8% of broadband households (50% x 91% x 17% = 7.7%), indicate that they would possibly discontinue their pay-TV services.

The possibility of pay TV losing ~8% of its customers is an obvious concern for the pay-TV market; however, there are a few reasons why we do not believe this translates to a loss of 7 million pay-TV subscribers the day after HBO’s OTT service is open for business.

- This isn’t just about HBO. The survey question asked consumers about their likelihood to subscribe to an HBO OTT service and other OTT services. Respondents were also asked about intention to subscribe to CBS All Access, as well as hypothetical OTT services from Cinemax, Starz, Encore, and Movieplex. Consumers were then asked which services they would cancel as a result of subscribing to one of these services. Although half of those that would take HBO’s service stated that they would also cut the cord, only a small portion would exclusively take HBO and then cancel pay TV. Many respondents stated that they would be likely to take the other OTT options provided as well. So, HBO is not the sole driver for the approximately 8% of consumers to cut the cord. It is, however, one factor in consumers’ decisions to keep or cut their pay-TV service.

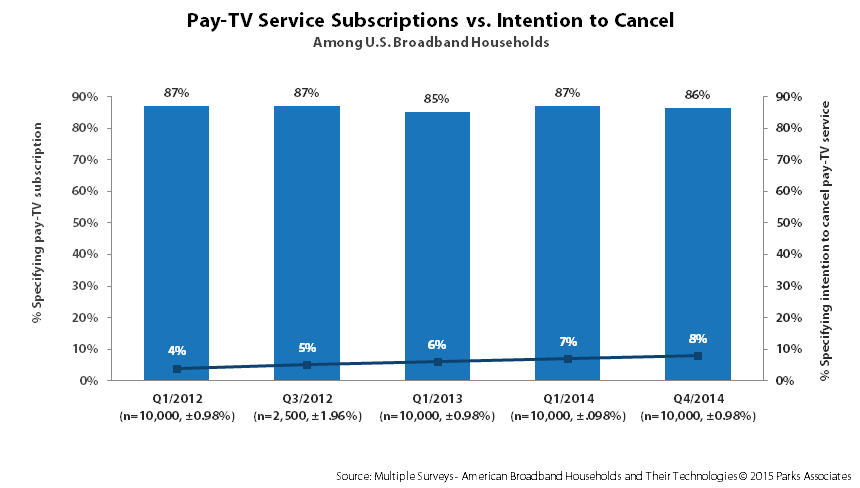

- Past data supports a disparity between intention and behavior. Previous surveys from Parks Associates tell a similar story of intention vs. behavior. As detailed in the chart below, intention to cancel pay-TV service has increased slowly among respondents over the past two years, reaching 7% in 2014. Importantly, the previous survey questions were asked to all pay-TV subscribers without reference to HBO or other OTT services. Yet, pay-TV service subscription penetration among broadband homes in the U.S. has remained stable. So, while many claim that they will cut the cord, few have actually done so.

- The data is a measure of sentiment. A survey of 10,000 households is a compelling sample. Clearly, a significant number of consumers are frustrated with the current pay-TV model and are open to other options. Still, consumers are responding to proposed services (excepting CBS All Access, which is currently available) rather than ones that are actually present in the market. The actual pricing, content, features, and experience of these services, and cord cutting overall, will likely temper actual activity among consumers.

Considering pay TV’s worst year was 2013 with a net loss of over 250,000 customers, a loss of 7 million customers would be catastrophic, almost 30 times the 2013 net loss. Such a shift would accelerate the change currently occurring in the industry as an increasing number of players provide OTT video directly to consumers.

Consumer frustration should be taken seriously. OTT services are becoming legitimate contenders in the TV service industry, and a notable portion of consumers feel they are willing to cut the cord if given expanded OTT options.

Anecdotally, because they know that I am an analyst for TV services, an increasing number of family, friends, and colleagues have approached me, seeking advice on “the best way” to cut the cord. Just the other day, I had a conversation with my father, who is in his 70s, about cord-cutting. The interest in cord-cutting is not fading away, and the fact that it is breaking out of the Millennial demographic should be a concern to players in the pay-TV industry. While the pay-TV industry is unlikely to lose 8% of its subscribers overnight, the data that Parks Associates presents is an accurate reflection of consumer attitudes toward the pay-TV industry.