The competitive landscape of residential security is rapidly changing. The entrance of tech giants into the security fold not only threatens traditional security providers but also helps to raise overall awareness of security offerings. However, traditional security providers do not have the technical infrastructure and quick-to-innovate agility of Google, Apple, and Amazon. This impending threat has weighed heavy on the traditional security industry, and as a result, new business models have emerged to shift away from the “traditional security offering”. Ad-hoc monitoring, DIY solutions, technological advancements all benefit the traditional player, but will that be enough to compete against the likes of Amazon?

Amazon illustrated its potential entrance into the security space with its recent acquisition of the popular video doorbell manufacturer, Ring. Ring’s reported $1 billion valuation goes beyond its hardware. Parks Associates estimates Ring has a roughly 70% share of the video doorbell market. Amazon’s purchase includes hardware as well as Ring’s smart home expertise, development abilities, rapid innovation and product development process, and distribution channel development capabilities. Amazon also purchased access to Ring’s upcoming security system offering. In the process of developing its new DIY security offering, recently rebranded as Ring Alarm, Ring began building out its own central monitoring station. Monitoring of the low-cost DIY system will reportedly be offered at $10 per month, a radically disruptive price point for traditional monitoring services. The combination of hardware assets, platform assets, and monitoring have all set Amazon up well for its next move – offering its own home security solutions.

Amazon today launched five "smart security" packages, which include installations from its own technicians and requires no monthly fees. Its pricing is aggressive given the recurring-revenue-fueled industry associated with home security. Its strategy is to offer a bundle of smart home devices to serve the purpose of a self-monitored security system. Disparate smart home devices originally sold on Amazon are now conveniently packaged together into bundles for the consumer. The packages offered by Amazon are outlined as follows:

- Outdoor Base ($250): A smart lighting offering meant to make it look like the home is occupied. It includes an outdoor motion-detecting LED spotlight, smart indoor lighting kit, Amazon Echo Dot, outdoor motion-detecting solar lights, and wireless waterproof speaker.

- Outdoor Plus ($490): The outdoor base package with a video doorbell included. Images from Amazon’s website showcases a Ring doorbell.

- Indoor Base ($320): A security package purposed for protecting the home’s interior. It includes a smart siren, motion/door/window sensors, smart indoor security camera, and smart home hub.

- Smart ($575): A whole-home security solution that includes a smart siren, motion/door/window sensors, an Amazon Echo Dot, a video doorbell, and a smart home hub.

- Smartest ($840): A more comprehensive home security solution that includes smart siren, motion/door/window sensors, Amazon Echo Dot, video doorbell, smart security camera, wireless waterproof speaker, smart air quality monitor, smart home hub, motion-detecting solar lights, motion-detecting LED spotlight, and smart flood and leak sensor.

The home security industry has long been dominated by traditional security provider giants such as ADT, which offered equipment in exchange for monthly contracts to monitor said equipment for a lengthy contract term (typically 2-3 years). The introduction of mobile and the ability to monitor security-related smart home devices are undercutting large security provider’s business models. Consumers are buying point solutions such as a networked camera, an all-in-one camera, or a DIY security system and monitoring their devices via a smartphone at no charge, and with no contracts. Parks Associates data illustrates this trend – among the 73% of broadband households without a security system 19% report a high likelihood of purchasing a security system that can be monitored/controlled via a smartphone, the same figure applies to a security system that does not require long-term contracts.

.png)

Expensive monitoring fees and long-term contracts are cost barriers to the average consumer. Parks Associates estimates that the average RMR for professional monitored security was roughly $44 in 2017. This cost for monitoring can seem a luxury for many consumers. Of the 73% of U.S. broadband households without a security system, a low-cost, enticing solution is necessary to move the needle forward.

Implications: The Battle for the Home

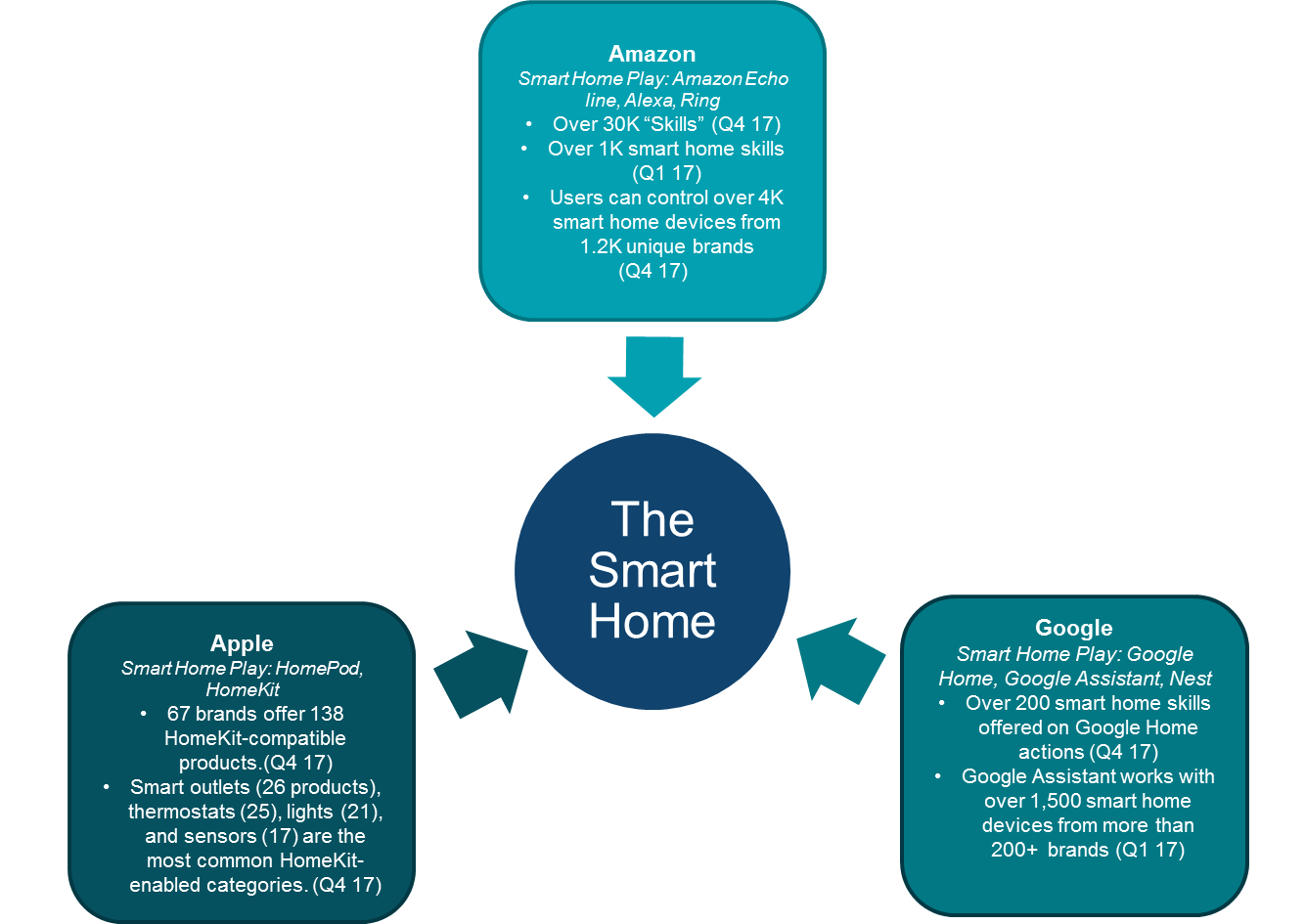

The real battle for the home is between Apple, Google, and Amazon. Amazon’s recent acquisitions and moves not only increases its expanding footprint in the smart home space but also stifles Google’s and Apple’s grasp on the home. Amazon will leverage its might in its new hardware acquisitions, increasing penetration in the home with its services such as in-home delivery (Amazon Key), and Amazon Echo line of products. The leading channel for smart home devices is security – any company that can leverage this channel, and leverage it well, will have unprecedented access to the home. Amazon’s widely popular smart speaker and personal assistant Alexa has already opened the door for this kind of ecosystem. At the end of 2017, Parks Associates data shows that among security system purchase intenders, 18% have a smart speaker – of which 12% have any Amazon branded speaker. This clearly delineates Amazon’s go-to-market strategy in utilizing its smart speaker devices in its security services packages.

Further Reading:

- A Look at Major Smart Home Security Systems

- 75% of 2017 home security installations included smart control features

- Residential Security and Encryption: Setting the Standard, Protecting Consumers