“There's an app for that” was a great slogan when Apple used it to tout its powerful device and app store support in the early days of smart phones, but as more and more companies develop their own apps and consumers use more connected devices, consumers want a unified control experience.

Currently, some level of unified control is available via smart home hubs, security providers, internet service providers, high-end custom installments, and even the master smart home apps on common smartphone operating systems. Yet, most smart home device buyers, most of the time, purchase devices one at a time at retail and are challenged with integrating those devices into their increasingly complicated ecosystem of connected devices at home.

Unfortunately for smart home app developers, the perfect unified app experience is in the eye of the beholder. There’s no industry that features uniform consumers but only the most challenging ones include consumers who are opposites.

The security industry is a key channel for smart home products and a top provider of unified control today. However, the tech giants, product OEMs, and other platform providers are all vying to provide a unified point of control to the smart home, and thus “own” the relationship with the consumer.

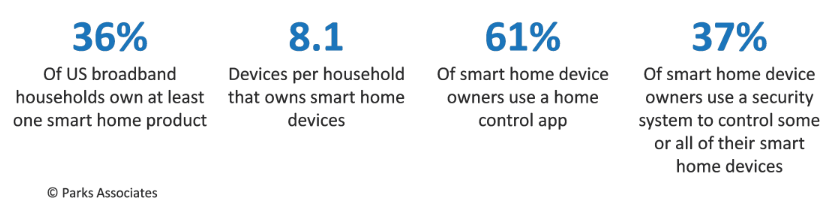

Our research shows that different types of smart home consumers have different needs and wants that may contradict each other. Use of and likelihood to use an app that controls multiple products increases with the number of devices owned. Security system owners are far more likely to own smart home devices. Of the 61% of smart home device owners using an app that controls multiple products, more than half use a security system app, among other methods.

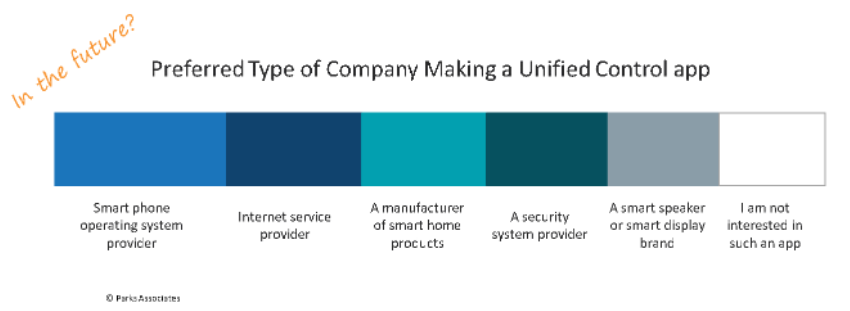

Interestingly, consumers show interest in unified app control from a variety of players. One-fifth most want a unifying app from their smartphone OS (Apple/Google), but nearly as many would look to their ISP.

The control opportunity in the home is huge, so an approach that targets a particular consumer segment or use case could still be a success. Consumers are buying more and more smart home devices, and they are open to adopting a single brand, so there could be substantial same-store sales or customer lifetime value if a unified app is adopted and compatible new devices are developed.

Smart home players seeking to play that unifying role may be most successful in crafting messaging that speaks deeply to certain consumer segments rather than a message designed for the masses. "To the person who values automation and smart energy devices due to climate change concerns, there's an app for you!" It doesn't have the same ring as Apple's pithy version, but it could ring the cash register.

This is an excerpt from Parks Associates consumer research study, All Apps Aren’t Equal: Smart Home User Experiences. This research provides an in-depth examination of the user experience among smart home app users. It evaluates consumers’ interaction and control preferences when using different types of smart home devices. This consumer study quantifies:

- Consumer preferences and pain points

- The value of unified versus endpoint solutions

- Relative importance of the app experience for purchasing and satisfaction

- Preferences for usage models of interaction, such as voice versus touch

Key questions addressed:

- What are consumers using to control their smart home devices?

- How is this impacted by the devices they own, services they use, their demographics, or other differences in the consumer groups?

- What is the level of interest in a unified app?

- Do consumers want simple, automated home control or the ability to customize with many layers of settings and controls?

- Which industry players are best positioned to provide the unified app experiences the consumers want?