The smart home starts at the front door, with devices like smart door locks, networked cameras, smart garage door openers, and video doorbells representing not only a foundation for security solutions but also access points for a future world of services, including in-home and in-garage delivery, home rental solutions, pet and cleaning services, and much more.

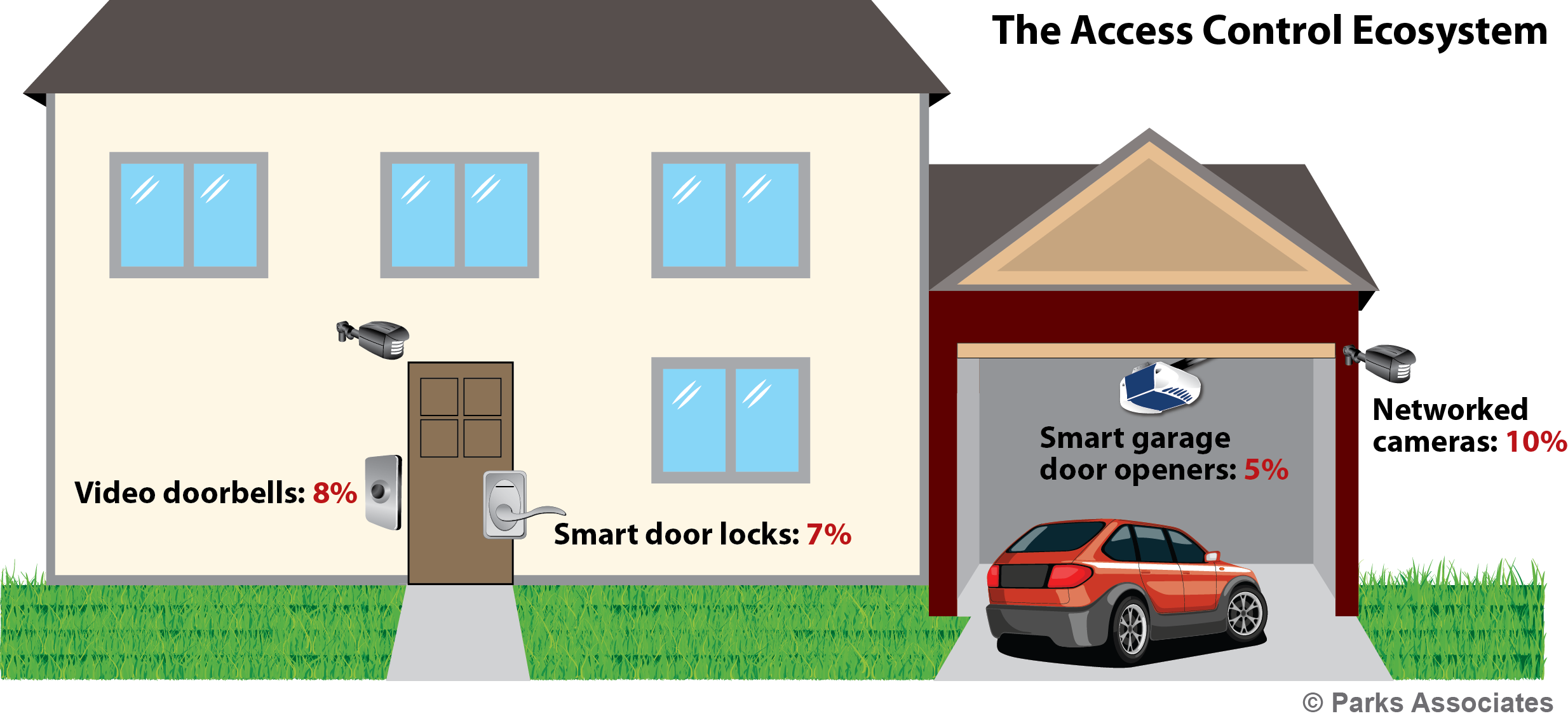

Parks Associates research shows video doorbells lead in adoption among the three primary access control devices. At the end of 2018, 8% of US broadband households own a video doorbell, 7% owned a smart door lock, and 5% owned a smart garage door opener. Further, 10% owned a networked camera, with fixed outdoor cameras playing an increasing role in the access control ecosystem.

These collective devices maintain a detailed record of who has entered the home, which doors were accessed and when, and even how long they stayed. These applications are allowing players in the access control ecosystem to evaluate key strategies toward home services.

A primary expansion opportunity includes leveraging the home’s access points to ease the home rental process. Currently, consumers find a great deal of value in access to the home:

- One-quarter of access control device owners or Intenders find it very valuable (Rating 6-7 on a 7-point scale) for their devices to give renters access to their home using home rental sites like Airbnb or HomeAway.

- Nearly a third of respondents (30%) would pay at least $15.99 per rental for this capability.

Homeowners using rental platforms, like Airbnb and HomeAway, can give renters access for specific time periods without worrying about lost or duplicated keys. Airbnb has partnered with smart lock providers including August Home, Danalock, Schlage, and Yale, allowing users to enjoy a streamlined check-in and check-out experience while also saving time for the landlord. For example, through Airbnb’s integration with August, smart locks generate an entry code the moment a reservation is confirmed. The code is timed for the length of the reservation and adapts to changes, so hosts do not have to worry about unwanted guests wandering in after their stay is over.

Consumers understand the value such a service brings, with more than half of respondents willing to pay at least $9.99 per rental for this capability. Partnerships with device makers and other connected companies are making it easier than ever to bring these services to market, but if past efforts have taught the industry anything, the ability to pivot quickly toward new opportunities and services is paramount.

Home services such as this solve real-world problems and drive convenience for consumers — two factors that represent expansion potential for players in the access control space. As device adoption continues to increase, the potential for home services like in-home and in-garage delivery, cleaning services, home rental solutions, and others will become more ubiquitous in the smart home.

For a more detailed assessment of the access control ecosystem, including a profile of the leading players in the space and their approach to enabling new services in the home, check out the Parks Associates industry report Battle for the Front Door: The Access Control Ecosystem.

Further Reading:

- Leveraging Smart Home and IoT for New Insurance Business Models

- 43% of US broadband households intend to purchase a smart home device in 2019

- My Next Home: Demand for Smart Homes and Smart Apartments