Parks Associates will be at ISC West next week checking out what's new for the security industry - not just for single family homes, but also multifamily, SMB, and we are starting to look at the commercial building market especially as it relates to access and control. If you are ISC, we would love to stop by and see what you are showing off! Contact Ashton Gambrell or myself to make sure we connect!

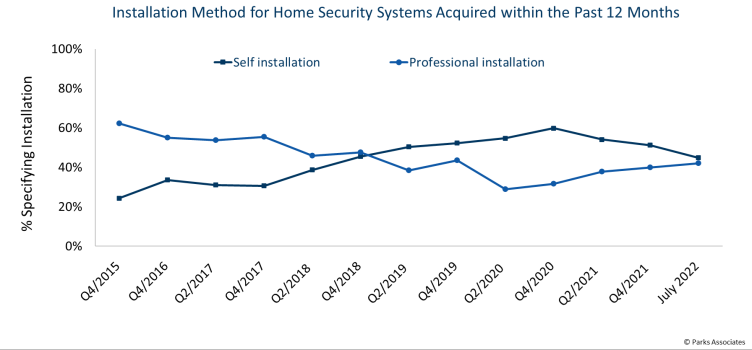

The 800-pound gorilla issue in the security device space is the prospect of colliding market segments. Market segments in the residential security industry continue to experience a blurring of lines between professional and DIY solutions. Professional installation and monitoring providers, such as ADT, Brinks, and Comcast, have added self-installation and monitoring options. At the same time, companies that started in the DIY space now offer professional installation and monitoring.

Providers expanding their solutions to address both professional- and self-installation provide consumers with the ultimate choice, increasing the reach of companies to new consumer segments. But it also increases competition in the industry, driving down pricing and making product differentiation more difficult. The bottom line is, however, that the incremental revenue opportunity associate with monitoring is huge: just 1% (~1% of new monitored households) could produce $1B, assuming a $40 monthly ASP with a three-year contract. Dealers, manufacturers, and resellers who recognize the significance of “lifetime value of a customer” (LTV) dynamic during the sales engagement phase can reap enormous profitable long-term value.

Consumers do benefit from this trend with lower pricing, but the risk of consumer confusion is heightened as feature differentiation among offerings is blurred. Moving forward, it is likely more companies will continue to “smudge” the lines and offer both professional- and self-installation. Despite the growth in DIY, there will always be a customer base that prefers professional installation. Companies will need to learn how to balance both preferences to remain competitive.

Staying Power of Professional Installation

Despite the rise in DIY solutions, companies continue to invest in professional solutions. As competition intensifies, ADT and Brinks are taking initiatives to maintain a stronghold in the market with professional installation as COVID-19 restrictions begin to lift (they may be re-imposed due to Delta) and consumers become comfortable allowing strangers into their homes again. Although DIY solutions have reached a new segment of consumers and grown the home security market as a whole, a segment of consumers will continue to desire or require professional installation. Those with in-house or contracted installer networks have an asset that is difficult for DIY players to replicate quickly or affordably.

This is an excerpt from Parks Associates ongoing research in the home security and smart home markets. Our data set is proprietary, built over 35+ years in business and developed with a research methodology that provides the most reliable, unbiased, and accurate view of the market. We would love to help you grow your security and smart home business!