Smart major appliances - refrigerators, clothes washers, microwaves, clothes dryers, dishwashers, ovens, water heaters, air conditioning units and range/cooktops - emerged in the US market in 2011. However, like smart home devices, adoption rates for different categories of smart appliances were fairly low. Adoption barriers such as high prices, perceived poor value proposition, slow replacement rates, and limited product availability have negatively impacted growth in these markets. However, the pandemic has put a new focus on the home and we have seen adoption numbers almost double in this category.

Developments in AI and new partnerships are helping appliance manufacturers to enhance the feature sets of smart appliances in an effort to meet core value propositions of improving convenience, minimizing waste, improving food quality, conserving energy, and improving safety. As the smart appliance market gains traction, more manufacturers have entered the space, increasing competition. Traditional players Maytag and Sharp both entered the market in 2019. In late 2019, tech giant Amazon entered the space with a smart microwave and smart oven. As market competition for smart appliances heats up, it will be important to understand which devices and features appeal to consumers and can drive competitive advantage.

Last year, at CES 2020 LG and Samsung introduced new versions of the LG InstaView refrigerators and Samsung Family Hub. These refrigerators boast integrated AI smart cameras that can identify different foods in the refrigerator. The integration of these cameras enables meal planning features that help users utilize the food they have on hand to minimize waste. The technology is also being leveraged to help users create grocery lists.

LG has introduced an AI-based feature called “Proactive Customer Care.” This feature monitors elements of appliances, such as temperature and air flow for a refrigerator, to alert users of potential problems. These new smart appliance features from Samsung and LG can drive market appeal through increasing convenience, product longevity, and value.

Smart appliances are gaining traction in US households. 2021 saw a huge jump from 13% adoption in all households to 22% for a smart major appliances. Smart refrigerators have a lead in the market due to early availability and currently 10% of all households own a smart refrigerator, an increase of 5% from 2020.

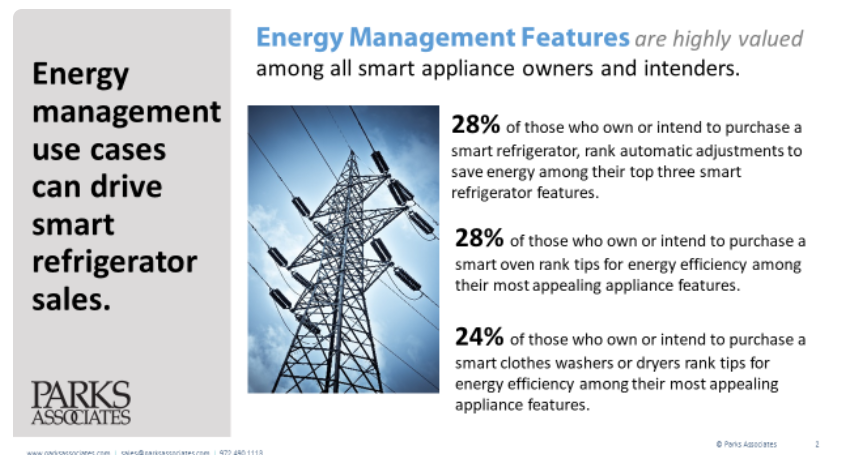

Energy management use cases can drive smart refrigerator sales. Consumers who own and intend to purchase smart refrigerators rank nearly all energy management features among the most appealing for the appliance. While most smart refrigerator brands offer some energy management benefits, Dacor’s smart refrigerator offers the most extensive feature sets for energy management.

Since smart appliances are high cost items, device manufacturers are working to drive strong product appeal:

- Create strong value proposition by including the features consumers find valuable and appealing for each appliance.

- Partner with retailers to secure display areas with high traffic and product visibility.

- Ensure products are reliable and easy to use.